Definitions: Are We Talking About the Same Thing?

Let's make sure we all have the same understanding of some basic media terminology!

Here's our very, very simple definition of reach:

Reach is how your friends talk about a TV commercial

|

When someone says, "Have you seen that ad with the funny talking kangaroo?", what they're asking is have you seen that commercial ever. They do not mean did you see it last Tuesday on CBS at 8:32 pm. They mean did you ever see it.

If you've ever seen the commercial, you've been reached. If you haven't, you haven't been reached.

Simple, yes?

Unduplicated Reach

This is a clunky term that only complicates things and you'll be much happier if you just avoid it.

When talking about the reach of an advertising campaign, we're counting up the number of people or homes that have viewed it. We only count each person once. If Bob saw the ad once, that means he did see the commercial and we tally him. If Susie saw the ad seven times, that means she saw the commercial and we tally her as reached. Bob and Susie have both been reached, so our reach count is two. It's not seven or eight, and five is right out. It's two, since every reached person is counted only once. That is, this count is unduplicated. OK, now that we've explained "unduplicated reach", try to avoid this term in the future because it confuses people. |

A person sees a commercial, and that's an impression. But when we add up impressions, what exactly is it that we are counting?

Here is the answer: An impression is an event. It's the lovely event that happens when a person and a commercial find each other. (Awww!) When we count impressions, we are counting the number of such events.

Bob is watching TV and sees our ad. An impression has just happened.

Susie spends Tuesday evening watching TV and sees our ad three times that evening. That's three events that have happened, and thus we count three impressions.

Bob and Susie have met (yay!) and together watch TV on Friday night, and see our ad three times. That's six wonderful occurrences of a person and an ad finding each other, so it's six impressions.

A crucially important fact about impressions is this: Impressions are the basis for how much you pay for a TV spot! (That's also true for a magazine page, or an outdoor billboard, or a web banner.) In general, if a single commercial placement produces twice as many viewing events as some other commercial placement, it will cost you twice as much (everything else being equal).

Universe

Universe is just the size of the target demographic. As of this writing, there are 114 million television homes in the United States with 289 millions persons age 2 and over. If we have a national campaign and our target is Women from 25 to 54 years of age, there are about 61 million of them. That's then our universe for that campaign.

Gross Impressions

This just means that we're adding up impressions, and it's a measure of the size of the ad campaign: "Our spring schedule delivers 5 million impressions."

But consider: is 5 million impressions a lot? Well, is it?

A commercial placed on "NCIS" locally in New York delivers a whole lot more impressions than a commercial placed on "NCIS" locally in St. Louis.

So, when we talk about 5 million impressions, we don't really have a notion of how much "oomph" that is until we relate that to the size of the target audience.

And that brings us to ...

GRPs (Gross Rating Points)

We can judge whether 5 million impressions is a lot by comparing it to a universe. Let's say that we have counted those events when an adult woman sees our ad, and that it comes up to 5 million impressions.

Well, if we're talking about a campaign in New York, there are about 4,000,000 adult women there. Comparing the 5 million impressions to the 4 million women, we can say that the number of impressions is 125% of the number of persons (5/4=1.25) . OK, that gives us some notion of the "oomph" we're placing in New York.

Now suppose we're talking about St. Louis, where there are 650,000 adult women. If we produced 5 million impressions in St. Louis, that number would be more than seven times the size of the target population. That is, the number of impressions is 769% of the number of people in our target (5,000,000/650,000=7.69).

Thus, 5 million impressions in St. Louis is much more oomphful than 5 million impressions placed in New York! And 5 million impressions to adult women scattered across the whole country isn't much at all.

What is the "Oomph" of 5 Million Impressions?

Where? |

Adult Women |

5 Million Impressions divided by count of persons |

As a percentage |

GRPs |

New York |

4,000,000 |

1.25 |

125% |

125 |

St. Louis |

650,000 |

7.69 |

769% |

769 |

National (U.S.) |

116,000,000 |

0.04 |

4% |

4 |

Rating

Rating is simply the averaged percent of a target that is exposed to a media vehicle at a moment in time.

We take the average audience and divide it by the universe. So, if 80,000 women in New York were watching at the average minute of a telecast, we divide that by the 4,000,000 women in New York to come up with a rating of 2%. We just say this is a 2 rating.

In a commercial schedule, you can add together the ratings you expect for each of the individual spot placements, and this also equals the gross rating points (GRPs), hence that name.

Frequency and Effective Reach

As Dan Rather once said, Kenneth what's the frequency?

Frequency is the number of times, on average, that persons who are reached will see your advertising

|

OK, you aired a commercial, so the people who were in the audience are going to buy your product, right? Eh, well, not really. Some were distracted, some were talking to someone else, some just zoned out. But then, later or another day, they see the same ad again. Perhaps there is some familiarity this time. Maybe not. So, maybe a third exposure will do the job. For a complex message, maybe an ad has to be seen 5 or 8 times. On the other hand, if it's announcing a huge sale right now good for today only, perhaps just 1 or 2 will do. This kind of discussion is at the heart of one of the most frequent questions in media, "How much frequency is enough?" (Pun intended.)

Your answer to that question is called your effective reach, or ER. You and your planning team will make decisions about that. In TView set your definition of effective reach on the Settings tab. Most commonly, effective reach will be set to say how many times an ad must be seen to have an effective result, something like 3 or more times, or 5 or more times or whatever. Some practitioners set an upper limit as well, such as specifying a range of 3 to 10. But there are important considerations about setting ER in that way. For more, read that topic here about effective reach.

Pay attention to an important subtlety in the meaning of frequency! Read the box above once more, and note the phrase "persons who are reached". Frequency is the average exposure among people who were reached, not among your whole target. When you put one single spot on the air, you may reach 2% of your target, and those people reached each saw it once, so the frequency is one.

Planners and Buyers and GRPs

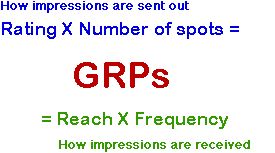

Media buyers study how advertising is sent out. So, for buyers the crucial formula is to multiply ratings by number of spots to determine total GRPs in a campaign.

Media planners and strategists look at how advertising is received. They need to look at the how many people were reached, and multiply that by the number of times they've been reached, to learn the effect of the GRPs being placed.

The Grand Unification formula of media is thus,

Frequency Distribution

Frequency is just an average, a single number. To learn much more about the pattern of how many times your ad was seen by your target, you may want to see a more complete frequency distribution, as either a table or a chart. (Click for the whole story.)

Quintiles

The complete frequency distribution gives a lot of information, but to distill it down we often look at quintiles, breaking up our audience into five groups from "heavy" to "light". This helps us tackle issues like whether too much advertising is going to just "heavy" viewers, or whether we are reaching "light" viewers.

But there are two different ways to say what we mean by "heavy" and "light": Do we mean how heavily or lightly people are exposed to our schedule? Or to the medium as a whole? (TView can do either.) Also, maybe we'd like some other kind of grouping, such as three groups ("terciles") or 10 groups ("deciles").

Read all about it in the topic, Quintiles and N-Tiles.

We all know someone who says things like, "I never watch any TV except for the news." And lots of people may love certain networks but never watch others. And perhaps some folks never have a chance to watch TV except at certain times.

To reach those people, you need to find them using the media vehicles that they do use. Some dayparts, networks or programs may be especially useful in exposing hard-to-reach folks. In your plan, we say that these vehicles develop an exclusive reach. For example, you may be considering a plan with 10 cable networks and thinking about cutting back by removing one of them. But even if that suspect network has a small audience, is it an audience that is not being reached by any of the other nine? If so, that network's exclusive reach is significant. If its exclusive reach is, say, 2.0, and you remove it from the plan with no other changes, your total reach immediately drops by 2.0.

Exclusive cume of the elements in your plan are strikingly displayed in the Contributions Chart on the Details tab, and also summarized in the Contributions Table.

You may be wondering how TView calculates exclusive reach. Bear in mind that TView is a respondent-level analysis system. That means that we work with all of the viewing information for every person in every home. (For the full scoop, see How TView Works.)

So, what we do NOT do is aggregate viewing into fractions of who did what. Instead, when TView computes reach, it looks and each and every person individually, and estimates whether that person will be exposed to each line in the plan.

You can see where this is going! If TView finds that a given person was exposed to one line entry, but not to anything else, then we tally that person as being in the exclusive reach for that vehicle.

When all the work is done for every person, then computing reach and effective reach is trivially simple: we just add 'em up!

Potential Audience and Cume Max

These juicy and important concepts are discussed at Cume Max: The Potential of the Components in a Plan.

Vehicle

We sometimes use the word "vehicle" to mean someplace where you can place an ad. It could be a television network or local station, or television for just part of a day, or a set of programs, or a specific program or a specific episode. A vehicle might also be some other medium or part of a media, such a radio, outdoor, online, etc.

Loyalty, Turnover and Time Spent Percent

You want your dog to be loyal. But loyalty may be a good thing and also a bad thing for a media vehicle. Loyalty (to a program, or a network, or a daypart) means that the audience keeps coming back to it. Having a dedicated, loyal audience sometimes is thought to transfer some goodwill from the vehicle to its advertising. Perhaps you're in a good mood, or have wide open attention, or just appreciate that a sponsor supports your beloved program.

But there is another side. If a large chunk of the audience is made up of loyal, dedicated fans, then each new spot you add to the schedule tends to get the same audience, building frequency more than reach. If you're trying to get up to effective frequency levels, then high loyalty vehicles will help you do that. But if frequency is piling up and what you really need to do is to expand the reach of your campaign, making use of low loyalty vehicles may help.

"Turnover" is a component's cume max divided by its rating. A vehicle that has high turnover needs more spots in order to achieve cume. On the other hand, this also means that you tend to get a fresh audience with each additional spot. You can find details about the turnover rates of the elements in your plan in the Contributions table on the Details tab.

"Time spent percent" is the flip side of turnover, and is computed as a component's rating divided by its cume max, and expressed as a percentage. A vehicle with a shorter time spent generates more reach for the same number of spots. Or, a higher time spent percent could indicate a component generating a more loyal audience, or more long-form programming.

Duplication

There is some overlap between the audiences of most pairs of media or vehicles. Some people watch Fox News, some people watch MSNBC, some people watch both. That is, there is some duplication in the audience.

So, what's the correct way to report duplication between some A and some B? Is it:

| • | the portion of the universe that uses both A and B |

| • | the portion of the universe that uses either A or B |

| • | the portion of A's audience that uses B |

| • | of people using either, those who use both |

| • | the percent increase of audience that A adds to B, or vice versa |

The answer is, all of them. There is no one "correct" way to report duplication. It's just a matter of understanding whatever it is you are trying to do.

As a special case, you will sometimes hear the term "random duplication". This means that two media vehicles combine in a way that knowing about usage of one tells you nothing about usage of the other. This is used in TView when combining audiences involving "other" media (not TV and not fused online vehicles). This is discussed in the topic Mixing in Other Media.

Other Sources on Media Terminology

| • | Nielsen Media Research’s Glossary of Media Terms - this is an extensive catalog of media terms and their definitions |